Land Tax Calculator Victoria Australia TAXIRIN

Share. The 2023-24 Victorian Budget delivered on 23 May 2023 includes various land tax changes, including increases to land tax and absentee (foreign) surcharge rates that will increase holding costs for a range of property owners. The Budget also introduces some land tax concessions that may assist a proportion of homeowners and home buyers.

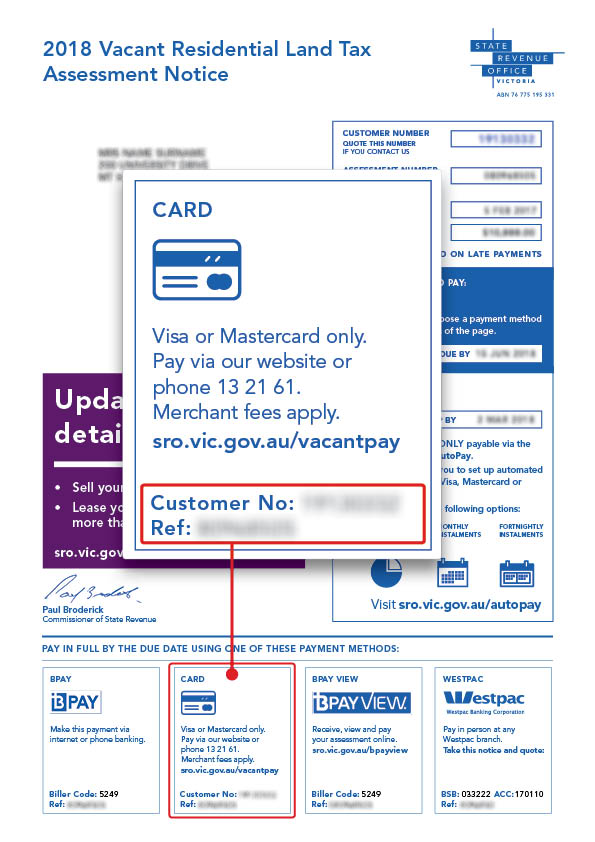

Pay your vacant residential land tax assessment State Revenue Office

From the 2024 land tax year a 4% absentee owner surcharge (previously 2% from 2020-2023 land tax year, 1.5% from 2017-2019 land tax year and 0.5% for the 2016 land tax year) on land tax applies to Victorian land owned by an absentee owner. You must tell us if you are an absentee owner, otherwise penalties may apply.

Land Tax Cate Bakos Property / Independent buyers advocate, qualified property investment

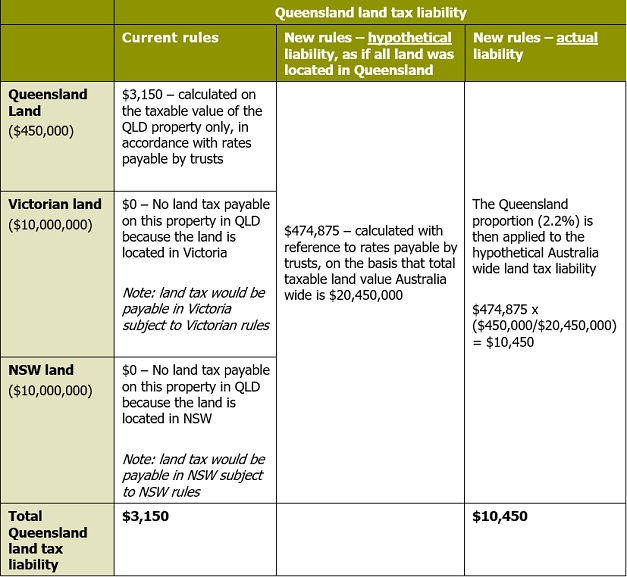

For trusts, the amount of land tax you have to pay is calculated in the following way: Total taxable value of land. Land tax payable. Less than $25,000. NIL. $25,000 to $250,000. $82 plus 0.375% of any amount more than $25,000. $250,000 to $600,000. $926 plus 0.575% of any amount more than $250,000.

Victoria’s windfall gains tax how much property owners will pay to rezone land

These are significant extensions. Extension to all of Victoria - dwellings: From 1 January 2025, vacant residential land tax will be extended to all vacant residential land across Victoria for properties which are unoccupied for more than six months a year, with the period that properties could be deemed vacant starting on 1 January 2024.

How is land tax calculated YouTube

We calculate the proportional tax on land using the formula (X ÷ Y) × Z where: Z = total tax payable. In Alice's case: Property C is exempt from land tax because it is her PPR so it's excluded from this calculation. Property A - ($620,000 ÷ $1,100,000) × $5,550 = $3,128.18 (i.e. 56.4% of her land tax liability).

How property taxes work by oconnorassociate Issuu

Oct 4, 2023 - 5.57pm. Holiday homes across Victoria will be hit by the state government's new $37 million-a-year vacancy tax, experts warn, despite assurances from Treasurer Tim Pallas they.

How does a property tax credit work? YouTube

The general rates for the 2024 Land Tax year are set out below. For example, if your taxable land value is greater than $3m, the rate of land tax is $31,650 plus 2.65 per cent of the value that exceeds $3m. A surcharge rate applies to land held on trust however this becomes the same as the general rate where land exceeds a taxable value of $3m.

Windfall Gain Tax and Massive Tax Hikes in Victoria

In Victoria, land tax is paid based on the calendar year and assessed on the value of all property you held on 31 December of the previous year. So, for 2023, the State Revenue Office will take into account all taxable property you owned at midnight on 31 December 2022.

How Do Property Taxes Work? YouTube

The Changing Landscape of Victorian Land Tax. In 2024, the land tax structure in Victoria will undergo significant changes. The new surcharge applies to different property value brackets, introducing additional charges for landowners. For taxable landholdings valued between $50,000 and $100,000, a flat surcharge of $500 will be imposed.

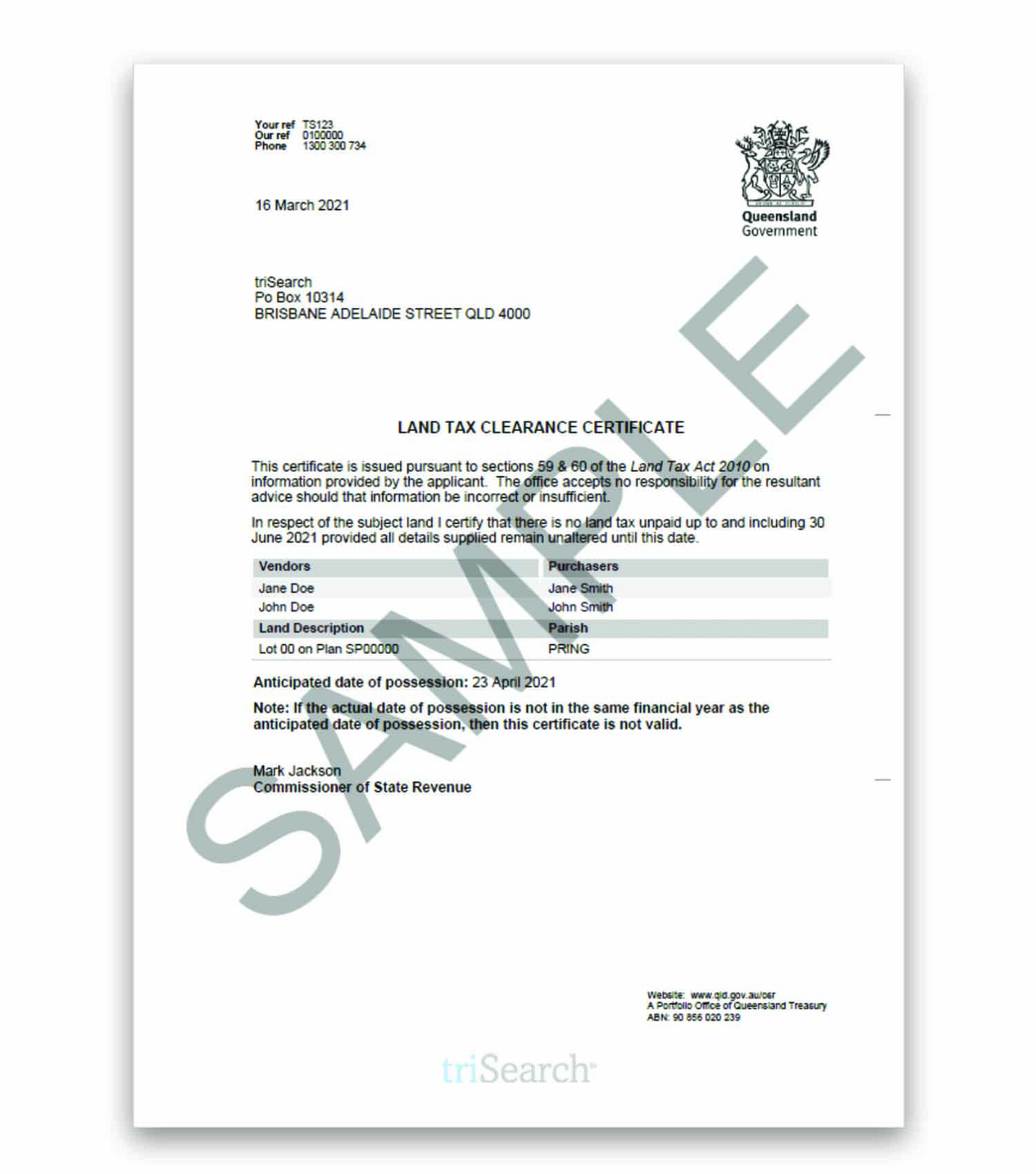

Land Tax Clearance Certificate triSearch

The land tax has certain exemptions and concessions only for certain kinds of property. To help you know about these, along with how it works, here is a guide on land tax in Victoria. Land tax - how does it work? You will have to pay land tax once the total taxable value of all the land you own in Victoria exceeds $300,000 on 31 December.

New Queensland land tax rules Queensland land tax rates to be based on Australia wide

The Land Tax Act 2005 (Vic) ( LTA) is the current legislation that governs land tax in Victoria. The LTA is administered by the State Revenue Office of Victoria. Imposition of land tax and liability. Land tax is imposed annually on all taxable land in Victoria. An owner of taxable land is liable to pay land tax on the land.

What is a Land Value Tax (LVT)? YouTube

Land tax applies for a calendar year. The rates shown apply for the 2024-2033 land tax years. For rates from the 2023 land tax year and earlier, go to Historical rates of land tax. Land tax general rates (from 2024 land tax year) Land tax trust surcharge rates (from 2024 land tax year)

Land Tax By State Australia WOPROFERTY

From 1 January 2024, new surcharges will apply and land tax rates will be higher for all taxpayers. New surcharges to result in higher land tax . For individuals and companies, the tax-free threshold will drop from $300,000 to $50,000. Higher land tax rates will apply above the new threshold. Land tax general rates (from 2024 land tax year)

How is agricultural tax calculated with example ️ Updated 2022

SPEAR is an online system for subdivision planning permits, certification applications and other surveyor-initiated land administration dealings. It allows users to compile, lodge, manage, refer, approve and track transactions. Complete end-to-end workflows are built into SPEAR, allowing applications to be lodged online with Land Use Victoria.

How does property tax work in Michigan? YouTube

Land tax. From 1 January 2024, the apportionment of land tax between a vendor and purchaser under a contract of sale of land will be prohibited. This prohibition will not apply to contracts where the consideration is $10 million or greater (to be indexed). Contracts entered into before 1 January 2024 are not subject to the new regime, and the.

Virginia Beach Virginia Property Tax Riadewntc

Additionally, the threshold for Victoria's land tax will be lowered from $300,000 to $50,000. The annual charge will apply to investment properties and holiday homes, not the family home.

.