What Is Indemnity Insurance And Do You Really Need It?

Protection and Indemnity Insurance (P&I) protects shipowners from third-party liability risks associated with owning and operating a vessel. It is one of the key coverages of ocean marine insurance, alongside hull coverage and cargo coverage. There is no standard insurance form for P&I coverage, though most will cover losses related to illness.

Insurance Explained What is Professional Indemnity? YouTube

The. twelve P&I Clubs. which comprise the International Group (the "Group") between them provide marine liability cover (protection and indemnity) for approximately 90% of the world's ocean-going tonnage. Through the unique Group structure, the member Clubs, whilst individually competitive, share between them their large loss exposures, and.

How Much Does Indemnity Insurance Cost? Heath Crawford

Protection and Indemnity (P&I) insurance is a type of marine insurance that provides coverage for third-party liabilities arising from the operation of a vessel. It covers a wide range of risks, including bodily injury, property damage, pollution, and wreck removal. P&I insurance is typically purchased by ship owners or operators and is often.

PPT KEY ISSUES IN MARINE INSURANCE FOR GLOBAL COMPANIES PowerPoint Presentation ID6238606

Protection and Indemnity (P&I) is a type of insurance that shipowners purchase to cover the potentially huge costs of any harm they accidentally cause to people, property and the environment. As liabilities for injuries, cargo loss, collisions and pollution can far exceed the value of a ship, shipowners have found since the 19th century that.

What Is Protection Insurance? YouTube

Protection and Indemnity Insurance is liability insurance for practically all maritime liability risks associated with the operation of a vessel, other than that covered under a workers compensation policy and under the collision clause in a hull policy. There is no standard Protection and Indemnity insurance form.

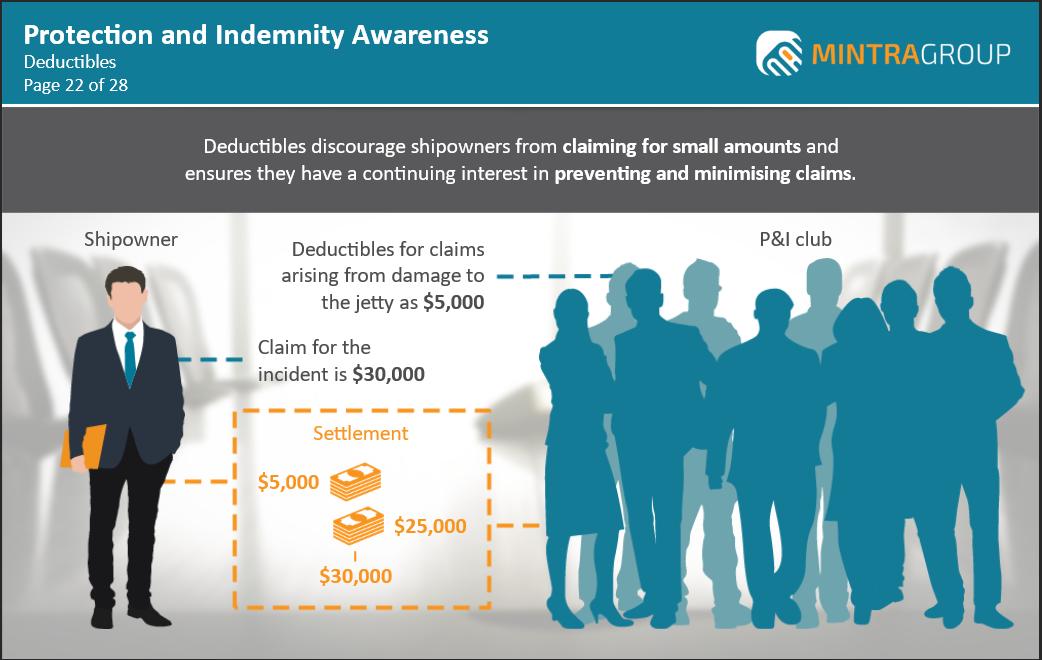

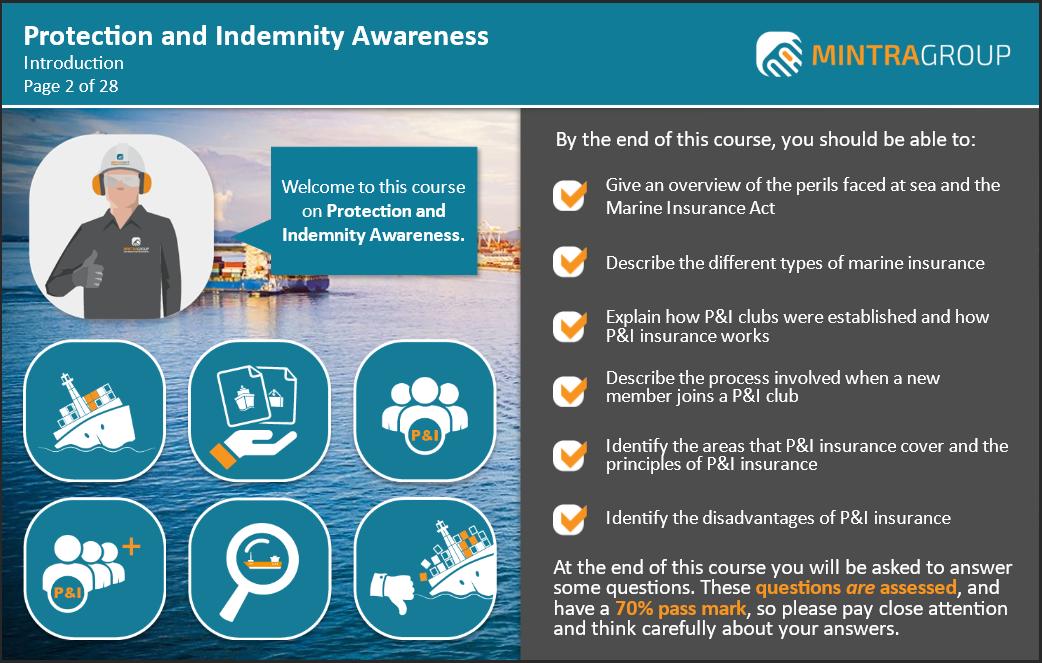

Protection & Indemnity Awareness (Maritime) Training Course

Indemnity is compensation for damages or loss, and in the legal sense, it may also refer to an exemption from liability for damages. The concept of indemnity is based on a contractual agreement.

Insurance protection services design template Vector Image

The most significant and costly exposure covered by P&I insurance is liability for loss of life, injury or illness, particularly the injury or death of crewmembers. P&I insurers cover their Assureds with very high limits of liability. The need for these high limits was the original motivating factor for the formation of the Clubs.

Protection Insurance Carew & Co Solutions

Indemnity insurance is an insurance policy designed to protect professionals and business owners when they are found to be at fault for a specific event such as misjudgment. Typical examples of.

What is the Principle of Indemnity? What are the Factors and Challenges of it?

Protection and indemnity insurance (often referred to as "P&I" insurance) is a liability insurance coverage. It covers maritime liability risks, including, notably: Collision liability. Damages to or loss of cargo. Liabilities imposed after pollution or oil spill. Wreck removal. P&I coverages are distinguished from hull and machinery.

Who Needs Professional Indemnity Insurance & What Does It Cover by Vijay Raj on Dribbble

Protection and indemnity insurance covers different kinds of watercraft, such as ships, boats, tugs, and barges. To acquire P&I insurance, the owner or operator of the watercraft must have it inspected by the insurance company or one of its representatives to record its condition, age, size, and claims history. The insurer will also collect the.

What Is Protection And Indemnity Insurance And Its Importance The Goan Touch

Protection and indemnity (P&I) liability insurance is specifically designed to address the unique needs of the marine industry. It covers practically all maritime liability risks associated with.

Here Is Why You Should Consider Getting Insurance Market Business News

A Protection and Indemnity or P&I club is a non-governmental, non-profitable mutual or cooperative association of marine insurance providers to its members which consists of ship owners, operators, charterers and seafarers under the member companies.

Protection insurance support benefits 5 things you should read Protection Guru

Indemnity clauses are included in contracts as a way of discouraging parties from breaching the underlying contractual agreement. What is indemnity. Indemnification is protection against loss or damage. When a contract is breached, the parties look to its indemnity clause to determine the compensation due to the aggrieved party by the.

Protection & Indemnity Awareness (Maritime) Training Course

The meaning of PROTECTION AND INDEMNITY INSURANCE is insurance for ship owners against loss due to legal liability arising from damage to cargo, injury to passengers and crew, and other legal liabilities not assumed under the regular forms of hull insurance.

What Does Indemnity Mean and How Does it Impact my Business? Foundry Law Group

Protection and Indemnity Insurance, often referred to as P&I Insurance, is a specialized form of marine liability insurance that provides coverage for a wide range of risks faced by shipowners, operators, and charterers. This type of policy offers financial protection against liabilities from third-party claims for bodily injury, property.

PPT Protection & Indemnity PowerPoint Presentation, free download ID1556573

In the U.S. these items are often part of your policy: Bodily Injury. Property damage. Death on the High Seas Act. Wreck Removal Maintenance & Cure. Negligence for unseaworthy vessel. Damage in "Rem" - Defense in the Admiralty Jurisdiction. From an exposure standpoint, the most costly is Loss of life, Injury or illness, particularly the.

.